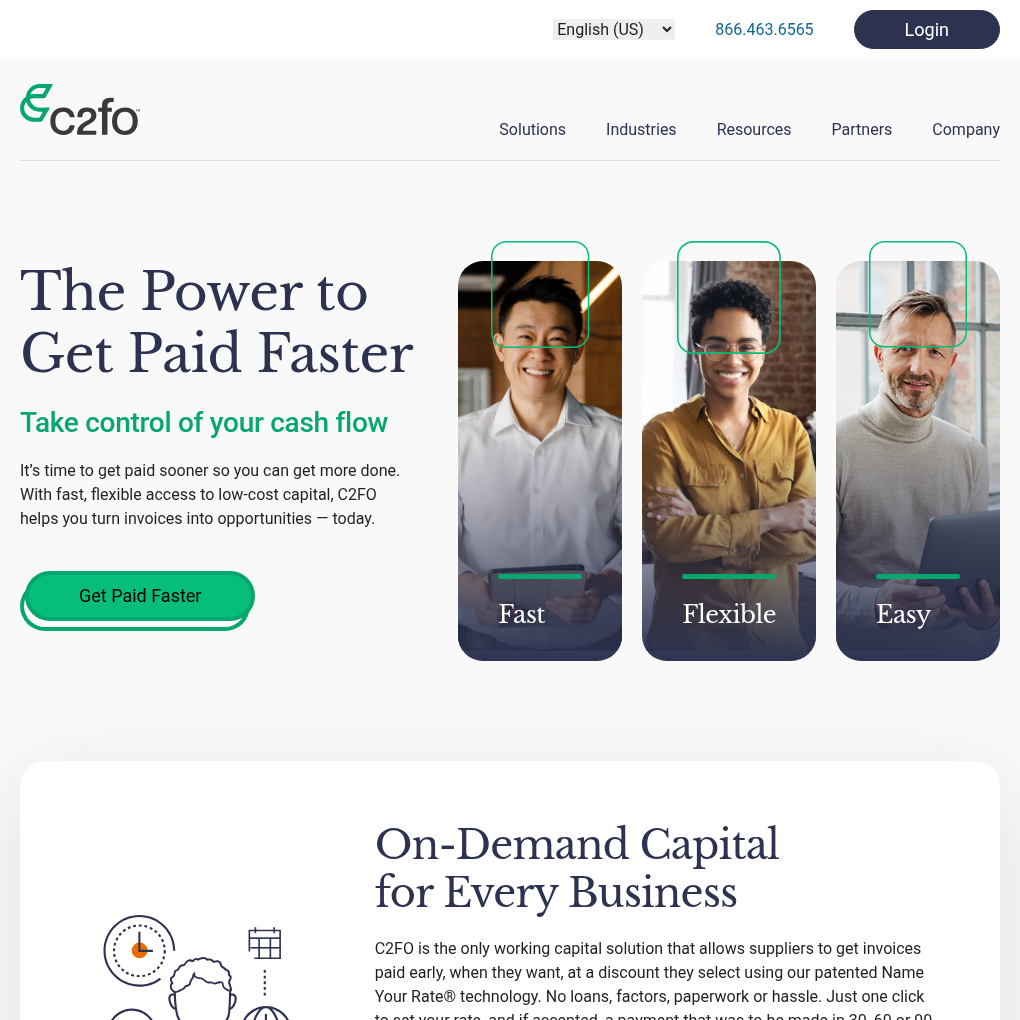

What does C2FO do?

C2FO provides an on-demand working capital platform that enables businesses to unlock liquidity from accounts receivable through dynamic discounting and supply chain financing programs, helping companies improve cash flow globally.

How much did they raise?

The company raised $30M in a funding round led by the International Finance Corporation. This non-series specific round highlights strategic investment in the enhancement of its platform capabilities.

What are their plans for the money?

With the new funds, C2FO aims to accelerate the technical development of its platform and expand its reach into emerging markets, beginning with a strategic rollout in Africa, particularly Nigeria. This expansion is expected to significantly improve access to working capital for businesses in developing nations.

What have they achieved so far?

C2FO has already demonstrated success, having enabled over $13 Billion in funding for more than 20,000 businesses in developing nations in 2024, underscoring its role in facilitating critical liquidity in emerging markets.